Many people forget that former Fed Chair Alan Greenspan’s now-famous reference to “irrational exuberance” was in 1996. At the time, he asked the provocative question: “How do we know when irrational exuberance has unduly escalated asset values?”

Investors are asking themselves this poignant question over and over again in recent months. When my Flybridge partners and I were preparing for this week’s annual investor meeting, we stepped back to reflect on how to balance the obvious exuberance we are seeing in the market with our robust optimism that there are sound, fundamental reasons behind this exuberance. We came up with the phrase, Rational Exuberance, as the best way to capture the moment that we find ourselves in. Yes, valuations have soared and we VCs are all paying more as we construct our portfolios. Yet, like other top firms in the industry, we are realizing that for our best companies, the scale of market opportunities has proven to be much larger than previously anticipated. Our entry price may be 30–50% higher, but we are investing in companies that are exhibiting 3–5x higher exit potential. That’s a trade we will take over and over again. Let me unpack why we — and many others — have come to this conclusion.

Rational Exuberance?

Valuations have soared to a record high in the last few years, particularly in the public markets. For example, the NASDAQ has increased 105% in the nineteen months since the COVID-19 crisis in March 2020. And from the public markets, those valuations have cascaded down to the later stage private market, where capital is pouring in at record levels.

As a result, the rise in startup valuations — particularly later stage startups — is dramatic. The chart below, drawn from Pitchbook’s latest data set, shows the sharp increase in the last two years. Later stage financing valuations have grown so sharply and on such a large scale that the magnitude of the change in valuations at Flybridge’s stage — the seed stage, labeled here the Angel stage by Pitchbook — is imperceptible.

But everyone in our small corner of the early-stage market has also seen substantial valuation increases. When we analyzed our seed-stage deals across three recent cohorts — 2017–2018, 2018–2019, and 2020–2021 — we saw that despite being located outside the ridiculously competitive Silicon Valley (our offices are in NYC and Boston), our post-money entry valuations have grown 56% and 33%, respectively (see chart below).

Interestingly, each of these cohorts raised more capital. The average seed round size for our portfolio companies in 2016–2017 was $1.7M while it grew to $2.6M in our 2018–2019 cohort and then $3.3M in our 2020–2021 cohort. Entrepreneurs are taking advantage of the higher prices to raise more capital in the seed round and thus make more progress before raising their series As — leading to dramatically larger series As at dramatically higher valuations. Crunchbase recently reported that the average Series A round has increased from $6M to $18M.

Come on Get Higher!

Why are valuations rising across the board across all segments?

The obvious answers are Economics 101 (thanks, Alan) and well covered in the daily newspapers: capital is chasing yield in a low interest rate environment, more capital drives up prices (simple supply and demand) and at the same time, when later stage and public investors do their future value math for growth companies, low-interest rates result in higher future value calculations — thereby valuing growth even more.

The less obvious answers are what we are seeing on the ground as we work with our companies day-to-day. First, technology innovation is affecting and disrupting the entire $23 trillion US GDP. We used to focus on a little small corner of the market called the IT industry. Today, every company is a technology company, and every industry — from healthcare to financial services to retail to real estate — is being disrupted.

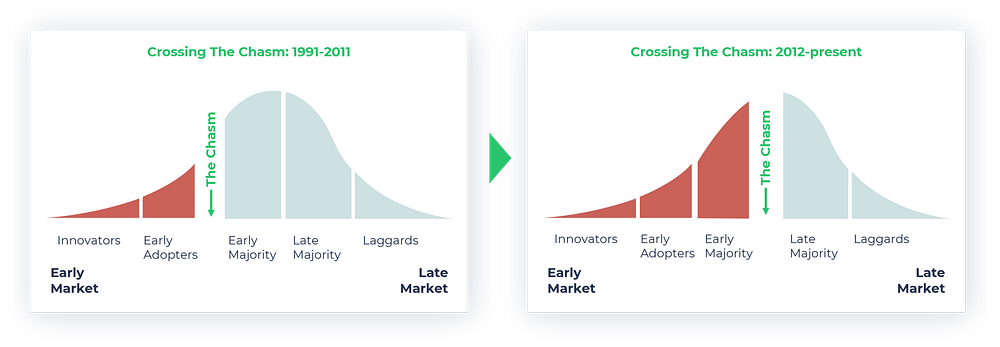

Second, with a nod to Thomas Friedman, the world has gotten flatter. Global smartphones have now reached over 80% of the world’s population up from 25% just six years ago, increasing the potential market for all of our companies. And, finally, as we study technology adoption patterns, we are seeing a fundamental shift to more rapid, earlier adoption of new products and services.

I have written in more detail about this phenomenon that we are seeing of faster technology adoption, framing the situation in the context of Geoffrey Moore’s canonical book from 30 years ago, Crossing the Chasm. In short, every business on the planet is realizing that they need to be an early adopter and embrace new technologies or they will be disrupted — think Blockbuster and Barnes & Noble. And every consumer has been trained to rapidly embrace new apps that make their lives easier and richer. As a result, the pace of technology adoption has quickened and the potential market size that startups can address in their early years — even if their product isn’t perfect and their organization is still nascent — has dramatically expanded. That’s why a young infrastructure company like our portfolio company MongoDB can count over half of the Fortune 500 as their customers at the time of their IPO a number of years ago.

All of this is leading to our conclusion that market sizes are proving far, far larger than we had ever imagined — surpassing our most optimistic forecasts and prognostication.

Faster Than a Speeding Bullet

We can see these trends play out across the entire tech ecosystem. For example, by looking at the revenue growth rates that the Big Five tech companies reported last quarter. Each of these companies, worth over $1 trillion, is supposedly operating mature businesses at scale, and yet they are still reporting growth rates in the 20–60% range — as if they were VC-backed startups.

Speaking of VC-backed startups, Bessemer’s recent report on the top 100 private cloud companies was also astonishing. Their analysis showed that on average, the revenue growth rates for these large private companies — as an entire cohort — have risen to 90% year over year while the top quartile is growing 110%. Again, these are large-scale companies defying the “law of large numbers”.

Recreating the Entire GDP of China…in 5 Years

As noted, these powerful forces driving accelerating revenue growth as a result of very favorable underlying market conditions and rapid adoption curves have led to unprecedented increases in valuation. We wanted to quantify this and so looked at the handful of Big Tech companies mentioned earlier along with the top 100 next most valuable tech companies and compared their change in market capitalizations from five years ago to today.

Even we were astonished to see the result. That cohort of companies has grown from $5 trillion to $20 trillion — an increase of $15 trillion. That is a staggering amount of value creation in tech in the last five years. To put that figure in perspective, $15 trillion is equivalent to the entire GDP of China.

Further, in our analysis of the top 100 most valuable companies, we noticed that 27 of these companies are newly public — that is, they were still private companies five years ago, invisible to the public markets and operating solely in the VC market.

Speaking of the VC market, these forces and favorable conditions have also led to the substantial growth in the number of unicorns (i.e., companies who have private valuations > $1 billion). Specifically, the number of unicorns has grown from 39 in 2013 to 842 today, a cohort worth nearly $3 trillion. Add that to the public growth and you have $18 trillion of market value creation in tech in the last five years.

Conclusion: Let the Good Times Roll

Thus, if we pull the camera back on the environment, it is clear it has been an exuberant period of time — but there are a good number of rational underpinnings to that exuberance. And with the advent of Zoom investing and remote work, the points of friction have been dramatically reduced and we are all operating at a velocity of 11.

No one can predict whether future public valuations and multiples will continue to soar or if we are heading into a market correction. But as I talk to my peers in the industry, there is universal confidence that we participants in startupland are on the right side of important secular trends. The shift towards global technology adoption for enterprises and consumers is a trend that is simply not going away. The rate of adoption of smartphones, apps, cloud, AI, data proliferation, and all the investment sectors that we and others have operated in successfully for the last two decades continue to dramatically grow on a global scale.

As a result, VC investors are finding our opportunity set to be as attractive as it has ever been in history. Of course, if everyone realizes that — and everyone does — more capital is coming. A lot more. I may not have Alan Greenspan’s economic wisdom or hubris about an ability to predict the future, but of that last point, I am quite certain.

special thanks to my colleagues for their insights and input — Matt Guiney, Chip Hazard, Julia Maltby, Justin Mead, Jesse Middleton, and Anna Palmer — as well as Asha Tanwar for her expert research and analytical assistance.