Michael Seibel of Y Combinator (YC) wrote a provocative tweet a few weeks ago, observing that MBAs who apply to YC appear ill-prepared. Below is the tweet and some of his follow-up observations.

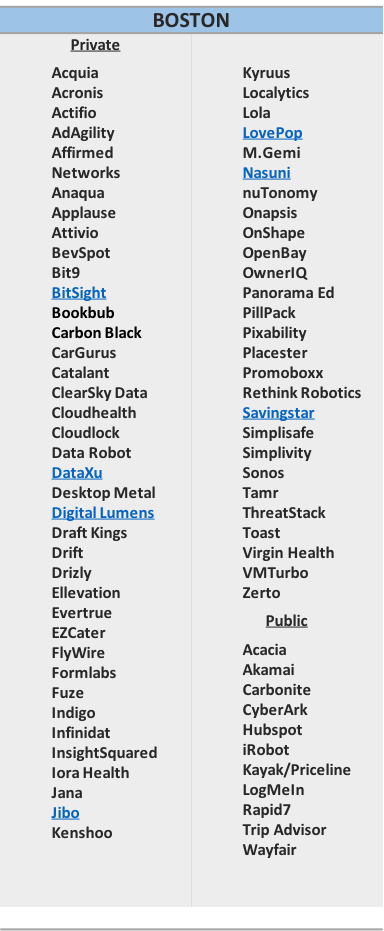

Although my day job is a seed-stage venture capitalist (at Flybridge Capital), on the side I teach entrepreneurship at Harvard Business School (HBS) – in particular, a 2nd year MBA class called Launching Technology Ventures (LTV) – and am proud of the fact that our students are performing very well in StartUpLand. Whether it’s unicorns like Cloudflare, Coupang and Grabtaxi, major exits like LearnVest or promising up and comers like Rent The Runway and Earnest, plenty of interesting companies have been created by HBS students right out of school in the last few years. And HBS alumni are proving to be effective and scaling and managing startups and large-scale tech companies years after graduation, not just starting them right out of HBS. Sheryl Sandberg/Facebook, Michael Bloomberg/Bloomberg, Mark Pincus/Zynga, Jeremy Stoppelman/Yelp, Meg Whitman/HP are among a few examples.

That said, I respect YC, its success in picking and training winners, and its immense experience as a startup pattern recognition machine. So I asked Michael for more detail regarding what he was seeing in MBA applicants so that we could make sure we’re addressing any gaps here at HBS. His feedback was interesting and I wanted to share it here (paraphrasing a bit and incorporating other feedback I hear in the marketplace):

- MVPs vs. Research – The knock on MBAs is that they classically spend too much time doing research and not enough time building a minimum viable product (MVP) and getting actual market feedback. We’ve done a good job of this at HBS, I believe, where Eric Ries (Lean Startup), Steve Blank (customer discovery) and getting out there and running experiments is hammered into each of our students in their first years. In the second year, we have electives like my class and others that emphasize this approach to company building. But clearly, we should be doing more, pushing our students to be builders not researchers.

- No Tech Co-Founder – We could have a robust debate about whether tech co-founders are critical given how many MBA startups have been successfully created without a tech co-founder (e.g., BlueApron, Warby Parker). That said, this criticism is an important one to address. Having technical proficiency is critical to being successful in StartUpLand and, further, having a technical co-founder helps immensely when it comes to MVP creation, iteration and general product development velocity. Velocity is one of the most important, least understood attributes of successful startups that is greatly enhanced by a technical co-founder. So, what’s HBS need to do here? Well, we urge students to mingle with their MIT counterparts, but that’s too passive. We’ve started an EIR program, but need more CTO types as EIRs. And Harvard is in the midst of moving its School of Engineering and Applied Sciences (SEAS) across the river to be co-located with HBS – and doubling its size (thanks, Steve Ballmer). In the last few years, CS50 (Harvard’s introductory computer science class) has been taught at HBS and this year, for the first time, a Code Club was created at HBS. Another major initiative – HBS is launching a joint MS/MBA degree, targeted at hybrid technical-business folks who want to enter StartUpLand. Good steps in the right direction, but clearly we need to do more. Next year, I’m determined to create more opportunities for organic mixing for techies given founders need time to get to know each other informally before leaping into a business partnership.

- Commitment. This one was the hardest to hear from Michael. He feels our students are not exhibiting full commitment to their startups but, rather, at times appear to be dabbling. I am sympathetic to his perspective on this. Like most VCs, I only invest in pigs not chickens. Too many MBAs are acting like chickens – not “all in” and exhibiting a willingness to pursue the startup no matter what. As Michael described, “One of our primary qualifications for getting into YC is whether this company would exist without YC.” There is no hedging your bets in StartUpLand.

Speaking on behalf of my HBS colleagues, I know we’re determined to keep pushing our students on these and other areas to make sure that we are producing startups that are embraced by YC, Techstars and other top-notch incubators – never mind investors – rather than appear like strangers in a strange land.

Michael and I did a podcast to continue this conversation on the YC blog, which you can listen to (or read the transcript) here.

(by the way, if you want to prepare for your YC interview, read this and this)

![Hacking Growth: How Today's Fastest-Growing Companies Drive Breakout Success by [Ellis, Sean, Brown, Morgan]](https://images-na.ssl-images-amazon.com/images/I/51KEv8n65hL.jpg)